— So It’s Ready When You Need It

Talking about aging and illness can be difficult, but experts have tips for getting started.

By Lynya Floyd

Iris Waichler sat at the kitchen table with her husband, Steven, and seven friends. They were gathered to discuss their single, childless friend Paul Mungrides. But this wasn’t a lighthearted chat about finding the 56-year-old a date. They were there to talk about his end-of-life wishes.

A few weeks earlier, Mr. Mungrides was diagnosed with an aggressive form of brain cancer that carries a 12- to 15-month life expectancy with treatment. He shared the news with Mr. Waichler, one of his best friends, who organized the rest of the group. They were the only people Mr. Mungrides could rely on for palliative care; his sole sibling lived out of state.

“We had plenty of time early on to talk about what he wanted, what his insurance covered, his finances,” Mrs. Waichler, a 68-year-old medical social worker based in Chicago, said.

Together, they devised a plan: One friend, a doctor, found Mr. Mungrides an oncologist. Mr. Waichler and another friend visited at night, watching Chicago Bulls games and helping Mr. Mungrides bathe. Mrs. Waichler did laundry, arranged meals and coordinated hospice care until Mr. Mungrides passed away in March 2012.

“We took care of him for almost a year,” she said. “We even arranged the memorial celebration.”

If this scenario sounds exceptional — like an ideal end-of-life story — that’s because it is. There are around 53 million unpaid caregivers in the United States, and their experiences don’t typically start with a detailed plan and a committed team. A partner is rushed to the hospital, or a spontaneous visit to a parent’s house reveals a bare fridge and stacks of unopened mail. Seemingly overnight, caregivers can find themselves alone and overwhelmed, careening toward burnout and exhaustion.

Creating a plan, even like the one Mr. Mungrides’s friends developed, won’t protect against every potential curveball. But carving out time before illness strikes to discuss wishes, assess resources, organize medical documents and, ultimately, outline responsibilities can make a fraught process a little less harrowing.

What to include in a caregiving plan

A comprehensive plan should list daily needs and designate a person to handle them once you or a loved one falls ill. It can be incredibly detailed, stipulating who will do grocery shopping or household chores, who will ensure medications are taken and prescriptions are refilled, and who will provide live-in care if necessary.

If you’re short on time, Aaron Blight, the author of “When Caregiving Calls: Guidance as You Care for a Parent, Spouse or Aging Relative,” recommended focusing on five questions: What care is required? When is it needed? Where will it be received? Who will provide the support? How will you pay for it?

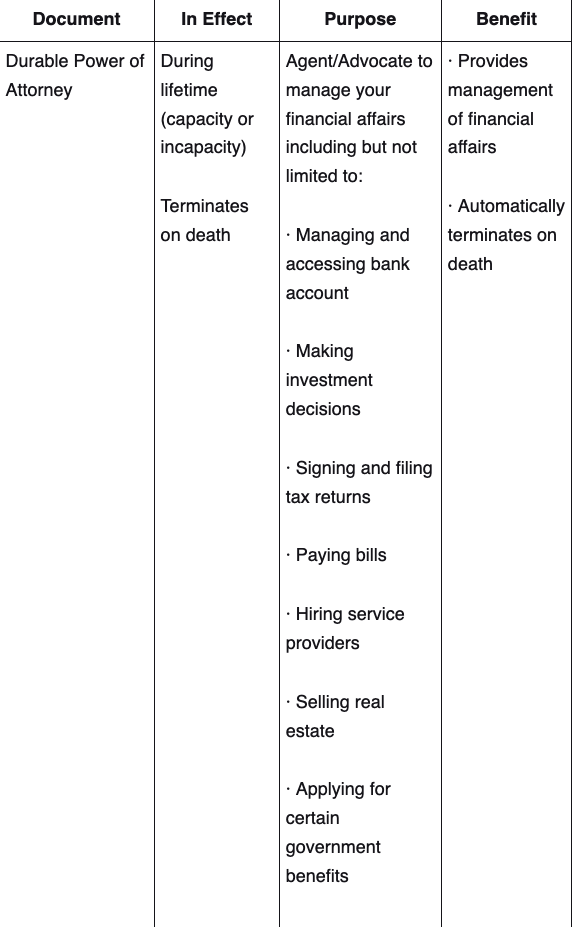

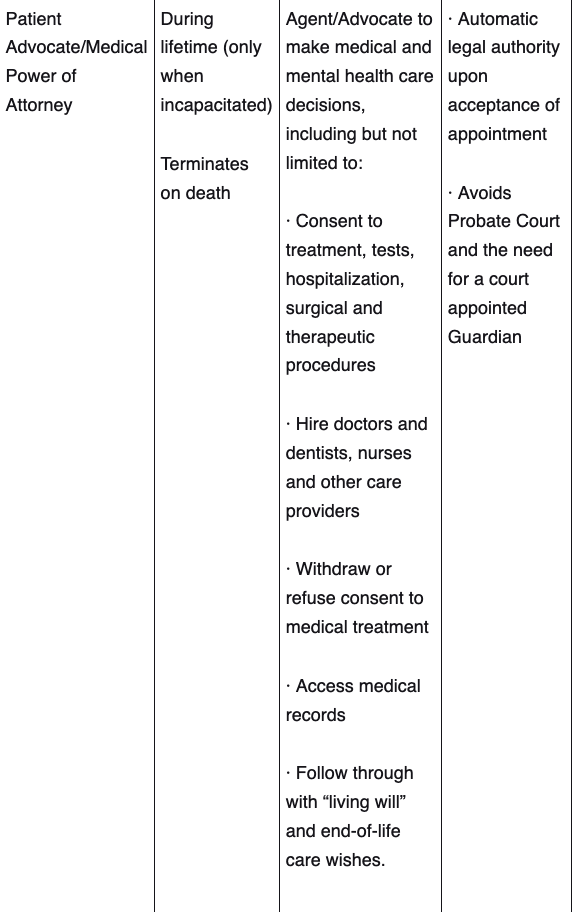

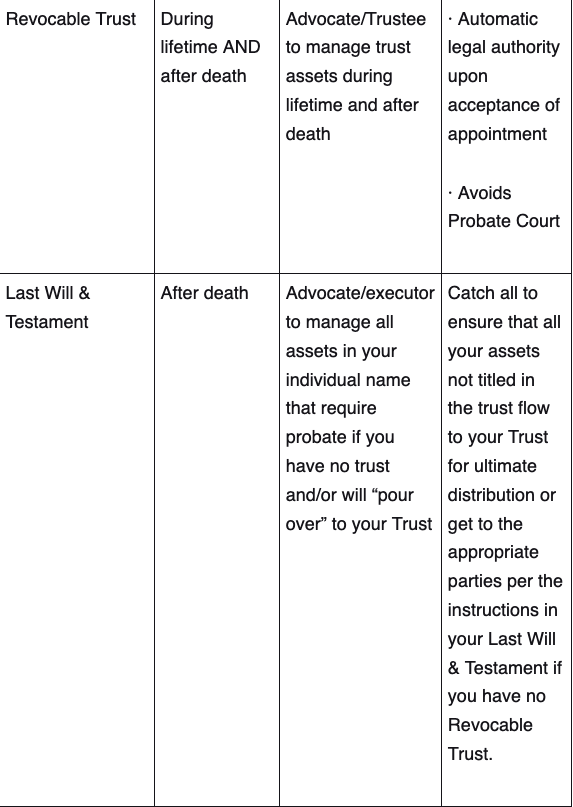

There are also legal decisions to make, said C. Grace Whiting, the executive director of the National Academy of Elder Law Attorneys. The legal titles and document names can vary, she said, but you should choose someone, like a health care proxy, to make medical decisions in the event you’re unable, as well as give someone power of attorney, so they can act on your behalf in financial, legal and other matters.

You should also write out an advanced directive, a legal document that provides, among other things, clear guidance about the level of care you want in a medical emergency if you can’t speak for yourself. And you should consider drafting a last will and testament that outlines how you want to allocate money, assets, intellectual property and other belongings.

If you are transitioning into a caregiver role, a legal care contract that describes the caregiver’s responsibilities and any compensation is also worth considering, Ms. Whiting said. “A lot of people just leave $300 a month on the kitchen table for the family member helping them,” she explained. “These contracts not only help avoid family disputes about where the money went, but also help you bypass tax implications down the road.”

Settling legal matters as early as possible will only make the caregiving experience easier down the line, and everyone can rest assured that those affairs will be taken care of. When Andy Jurinko’s pancreatic cancer progressed in the winter of 2011, his wife, Pat Moore, called a lawyer to finalize paperwork.

“It is the worst thing in the world to be laying in your bed, dying, and having a lawyer ask you questions about who should get what,” Ms. Moore, 69, a sweater designer from New York City, said. “If you wait until the last minute, you’re in such a bad place.”

How to broach the conversation

Several caregivers we spoke to cited another person’s crisis as a catalyst for caregiving discussions. “After 9/11, my parents did most of the work themselves: meeting with lawyers and having a binder made up of all the documents we’d need,” Kitty Eisele, the host and creator of “Twenty-Four Seven: A Podcast About Caregiving,” said. “They came to us and said: ‘Here’s the paperwork, here’s the lawyer’s contact info. If something awful happens, you know what to do.’”

But for those who may be reluctant to have those conversations, there are other ways to begin talking about caregiving with loved ones:

1. Start with goals instead of problems.

It’s tempting to problem-solve when you’re concerned, but Liz O’Donnell, the founder of Working Daughter, a community for women balancing elder care with their careers, warned against that approach. Instead, she said, ask open-ended questions that give loved ones agency and allow them explore possibilities.

“It’s not, ‘You know you can’t live in this house anymore’ or ‘It’s not safe for you to drive anymore,’ but ‘What’s important to you as you look at the next phase of life?’” she said.

Claudia Fine, a licensed social worker and chief professional officer at eFamilyCare, suggested explaining that caregiving is somewhat inevitable — most people will eventually need it — while keeping a positive tone. “You can say: ‘At some point, before we have a crisis, I’d love to know what your thoughts are for if something were to happen; that way I can support you in this,’” she said.

2. Remember that you’re on the same team.

Conversations about caregiving can become contentious, but “the preferences, likes and dislikes of the person receiving care should be at the forefront,” said María P. Aranda, a professor of social work and the executive director for the Edward R. Roybal Institute on Aging at the University of Southern California. “It’s a shortsighted approach to not engage that person in their own care trajectory.”

You can also decide together who else might be able to help. “There’s an assumption that there will only be one caregiver present during the entire journey,” said Dr. Aranda, who suggested an approach that involves multiple supporters who can change over time.

3. Expect several conversations.

“It’s like asking for a raise,” Ms. O’Donnell said. “You don’t get it as soon as you walk into your boss’s door. It’s a negotiation.”

You might get shut down the first time you bring up the topic. “To you, this is just a conversation about practicality, safety and support,” Ms. O’Donnell said. “To them, it’s about loss, lack of independence and more change in a time when they’re already experiencing a lot of change. There can be a lot of fear around this.”

It’s also possible that your best-laid plans will need tweaking over time. Caregiving is dynamic, and what seemed like a perfect solution might prove ineffective later.

4. Lean on templates and icebreakers.

If you’re struggling to find the right approach, there are many resources available. A public health initiative called The Conversation Project, for example, provides free guides and scripts for starting conversations as well as communicating wishes for end-of-life care. There’s even a card game called Hello! that aims to ease participants into discussing their feelings about living and dying.

Managing care and expectations

Even if you create a plan, caregiving may still come with obstacles. “Sometimes there’s no rainbow at the end of the tunnel,” Dr. Aranda said.

After realizing that her parents would eventually need more support, Dr. Aranda and her sister had a conversation with them about hiring a home health aide. “They looked at us very perplexed and I thought, ‘This is not going well,’” she said. “The idea of having hired help coming into the home was foreign to them.”

Dr. Aranda and her sister ended up taking on more responsibility and increasing the hours they spent with their parents. But honoring someone else’s wishes for their care doesn’t mean you have to set aside your own needs. Experts recommended prioritizing self-care that goes beyond the occasional spa day and focuses, instead, on finding resources that yield financial, physical and emotional support.

“Many caregivers don’t know what services are available to them,” Dr. Aranda said. To explore your options, she recommended asking health care professionals, senior organizations and other caregivers how to get access to resources that could be helpful. “It’s amazing to see how families can learn from one another,” she said.

Revisiting your medical or employee benefits might also uncover things like insurance coverage for therapy appointments, family and medical leave to focus on caregiving or discounted daily care services for adults.

And online caregiver support groups can provide a safe space to vent. “Caregiving can be a lonely road,” Dr. Blight said. “But the friendships that you develop and the people who support you through these difficult times are often relationships that last beyond the season of caregiving.

Complete Article ↪HERE↩!