— One tip: Do it over chocolate cake.

By Jancee Dunn

I recently hosted a strange family gathering: an end-of-life lunch.

It was my sister Dinah’s idea. She had been saying for months that it was time to discuss my parents’ final wishes while they were both still able to weigh in.

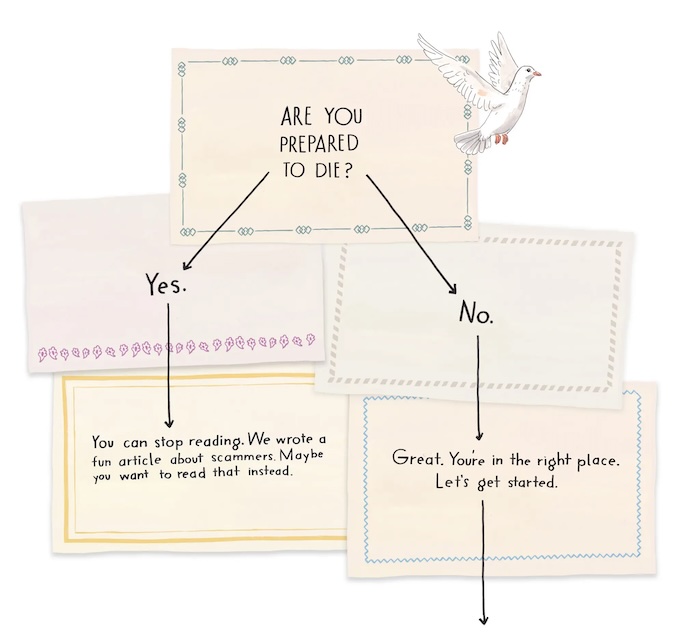

But I kept putting off the conversation. Who wants to think about it, whether it’s your own or the death of someone you care about?

Research shows that fewer than one third of U.S. residents have advanced-care directives, or detailed medical instructions in the event they can’t communicate their own wishes. Without such instructions, loved ones are left to use guesswork, which can be confusing and chaotic.

So I pushed past my reluctance and invited the family over to talk about everything from their positions on resuscitation and funeral plans to who will take their cats. I even tried to make things festive by ordering pizza and baking a chocolate cake.

I learned things about my family that I never knew: My mom and dad don’t want a memorial service. (“We don’t like big gatherings, whether we’re alive or dead,” my mom explained.) My sister Heather, meanwhile, wants hers to be held at Starbucks. (A Starbucks rep said that while this was “definitely a unique inquiry that we don’t get across our desks often,” they declined to comment further.)

Our lunch was occasionally weird — my dad once read that your “cremains” can be pressed into a working vinyl record, and he briefly floated the idea — but the gathering wasn’t as sad or awkward as I imagined it would be. Instead, it was a relief to chat openly about my folks’ end-of-life wishes instead of repeatedly stashing them away.

If you’ve been putting off these discussions, here’s how to get started.

Schedule a conversation.

First, ask your relatives if they’d be open to a family meeting — in person or on Zoom — and then set a date.

If you need a conversational starter, Mirnova Ceide, an associate professor of geriatric psychiatry and geriatrics at Albert Einstein College of Medicine, suggested bringing up a news story about dementia. “You can say, ‘This got me thinking about how important it is for us to talk about these issues now,’” she said.

If you are the older relative, consider initiating the family meeting yourself, Alua Arthur, an end-of-life doula and the author of the upcoming book “Briefly Perfectly Human,” suggested.

It might feel uncomfortable to broach the subject, she explained, but you can think of getting your affairs in order as a posthumous gift to your family.

You are sparing them a scenario “where they are in the midst of tremendous grief, and then they’re also trying to figure out what to do with all your stuff and where to find your passwords and everything else,” Arthur said.

Prepare a checklist.

Create a document that the whole family can access, and assemble a checklist of topics and prompts to go over, Dr. Ceide said. A good source for questions, she said, is the end-of-life guidelines from the National Institute on Aging.

The two vital things to discuss in the initial meeting, Dr. Ceide said, are who will serve as a health care proxy, acting as your stand-in for health care decisions, and what directives should be in your living will.

“We cannot exert control over the timing and nature of our death,” Diane Meier, a professor of geriatrics and palliative medicine at the Icahn School of Medicine at Mount Sinai, added. “You cannot anticipate exactly what the circumstances will be. So the most important thing to do is to identify someone you trust to speak for you if you are unable to speak for yourself when decisions need to be made.”

The institute also has a list of ways to create advance directives for little or no cost. (And Medicare covers advance care planning as part of your yearly wellness visit.)

Once you decide on your health care proxy and draft a living will, you can make it official by completing a durable power of attorney for health care, a legal document that names your health care proxy. Then distribute copies to your doctor, loved ones and, if you have one, a lawyer. (A lawyer is helpful but not required, according to the institute.)

Get reflective.

Our family had a long talk about how my parents wanted to spend their remaining years. Arthur, the doula, suggested asking: What is still undone in your life? “Because that helps you figure out where you want to place your time and energy,” she said.

We went over the things our parents still wanted to do, and how we could make them happen. My parents said they hoped to travel locally a bit more. My dad wants to attend his 65th high school reunion in Michigan (“at my age, they do it every five years”). Dinah, my sister, said she would accompany him.

Another helpful resource is the Stanford Letter Project, a free website that offers tools and templates for writing a “last letter,” a personal message of gratitude, forgiveness or regret to share with the people you love.

Consider regular check-ins.

End-of-life care is likely too big a topic to resolve in one meeting, Dr. Ceide said. She encourages families to have a regular conference call to check in.

Doing this can help you get on the same page so you’re all aware of, and planning for, issues like getting a ramp for your parents’ house, Dr. Ceide explained. You’re able to address “little things as they come so that when the bigger issues happen, you already have an infrastructure and a comfort with communicating together about these things.”

After our meeting, my father asked me to pack up a piece of chocolate cake to take home. “After all this death talk, I should probably seize the day,” he said.

Complete Article ↪HERE↩!